As the end of Q2 approaches we have had a significant increase in questions regarding the appropriate implementation of the new SEC marketing rules. Lightkeeper has prepared FAQs that we hope are beneficial as you consider this very important and timely topic.

Why do I need to change my current reporting methodology?

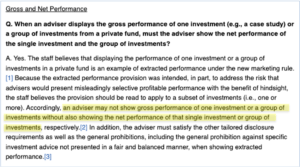

In May 2021, the SEC adopted new rules which broadly affected marketing. While there was some confusion as to whether or not that rule applied to certain funds and/or reporting, the SEC then issued a Frequently Asked Questions Document on January 11, 2023 which seemed to provide more clarity. The highlighted comment included in that FAQ has changed the thinking regarding the application of the rule:

Since the release of the FAQ, Lightkeeper has discussed the implications with many clients and industry professionals. A consensus appears to be forming that the rule does indeed apply to client investor and marketing reporting. To that end, clients have looked to Lightkeeper to assist with an automated and consistent solution for adjusting their reporting methodology.

Can Lightkeeper help me with an automated solution?

Yes, Lightkeeper has developed automated solutions which enables clients to report net attribution for their instruments. Lightkeeper offers two methodologies: the first, allocates fees and expenses based on instrument-level performance, and the second option does that allocation based on average instrument-level exposure for each month. Using either automated solution enables clients to report net attribution by name or rolled up by other tags such as Sector, Market Cap and Geography. The Lightkeeper net allocation solution can be easily viewed and interacted with across the entire platform, including within the user interface along with all customized reporting.

Why did you decide on the methodologies you are using?

Lightkeeper has had numerous conversations with clients and industry thought leaders which led to the consideration of a few different allocation methodology options. After reviewing the different methodologies and running many scenarios across various fact patterns and time periods, the performance-based allocation methodology consistently generated the least amount of skew and edge cases. As Lightkeeper discussed this methodology more with clients, there appeared to be some consensus that the performance-based methodology was a reasonable and consistent approach to addressing the new rule change. Despite the growing accord in the performance-based methodology, a number of clients preferred an exposure-based approach, and accordingly, Lightkeeper has developed a second methodology for clients.

We manage a hybrid fund that has a different fee structure for private investments than for the public equity portion of our fund. Can you also automate reporting for that fact pattern?

Yes, Lightkeeper develops custom business logic to assist clients with diversified fee structures for reporting net attribution.

What if we want to use a different methodology than the one Lightkeeper provides?

We are actively working on additional automated solutions and expect more to be available in the coming weeks. In addition, Lightkeeper’s Solutions Team would be pleased to discuss your preferred methodology and the work required to provide a custom solution for your reporting needs.

The new rules require Net Returns for 1, 5 and 10 year reporting periods. Can Lightkeeper produce the Net Return numbers for these periods?

Yes, Lightkeeper’s advanced technology platform provides an efficient solution to ingest all your relevant portfolio data for the entire history of your funds. Our dynamic computation engine provides an “on demand†approach allowing clients to visualize net attribution returns quickly and easily for any and all time periods.

Can Lightkeeper produce investor reporting that displays Net Attribution?

Yes, Lightkeeper can fully automate your investor reporting outputs and include gross and net attribution by whatever tags you report (i.e. Sector, Market Cap, Geography, etc.). Lightkeeper’s robust reporting engine can match all formatting of your current reporting such as logos, color schemes, footnotes and disclaimers.

Lightkeeper provides data management, advanced analytics, and insights for investment managers to streamline, evaluate, and enhance investment and business processes across the entire organization. Recognized as the industry leading portfolio intelligence and reporting platform, Lightkeeper serves 130+ clients representing $500bn AUM.

To learn more about Lightkeeper and to schedule a demo of our platform, please contact us at info@lightkeeper.com